NFTs are being done through Stacks, which settles its transactions to the Bitcoin blockchain.

Is NFT possible in Bitcoin?

We might me thinking that Bitcoin is not turing complete and doesn’t have the smart contract capabilities of Ethereum and other networks, so it cannot run the code needed to operate NFTs, Defi protocols, and Decentralised Apps. But stacks solves this problem.

What is Stack?

Stacks is a blockchain that can run smart contracts, and ultimately rolls up all of its transactions and settles them on Bitcoin. It’s a layer-1 blockchain, but takes a similar approach to Ethereum Layer-2 scaling solutions. It gives BTC the ability to be trigger smart contracts, enabling DeFi, NFTs, and Web3.

NFTs secured by Bitcoin:

Just as Stacks can enable Bitcoin based DeFi protocols without wrapping BTC for use on Ethereum, its smart contract capabilities can also power NFTs backed by the security and liquidity of the Bitcoin network.

Advantages of Stacks:

Stacks performs a lot of the work away from the Bitcoin mainnet, however, so the individual transactions are faster, cheaper, and less energy-intensive.

Old Bitcoin NFTs:

Years back, before anyone knew what an “NFT” was, visual assets were tokenized and share via Counterparty a protocol that is built atop Bitcoin. Pre-NFT collections like Rare Pepes (2016) have since been wrapped and transferred over to Ethereum for more recent transactions. One Rare Pepe sold for $687,000 worth of ETH in Spetember.

Advantages of NFTs on Bitcoin:

Bitcoin is the largest cryptocurrency by market cap, and its most ardent supporters are often maximalists, shunning all other cryptocurrencies and their networks as a result. Paired with Stacks’ scalable tech, it might help these NFTs stand out in an increasingly crowded market.

Successful NFT projects in Stacks:

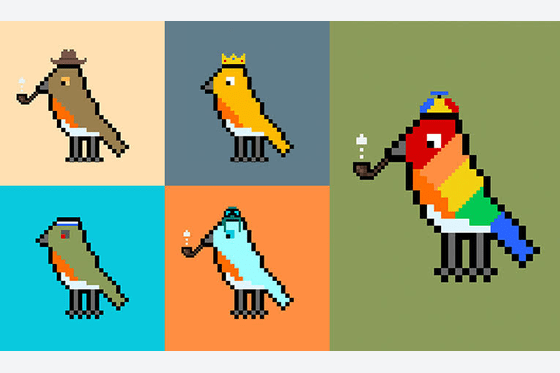

Bitcoin Birds:

Bitcoin Birds was developed by Abraham Finlay, a 12-year-old boy, according to a local news report from Oregon’s Roseburg Tracker, generating about $8,000 during the sold-out minting process. As of this writing, the cheapest-available Bitcoin Bird NFT on the StacksArt marketplace is listed at 7200 STX.

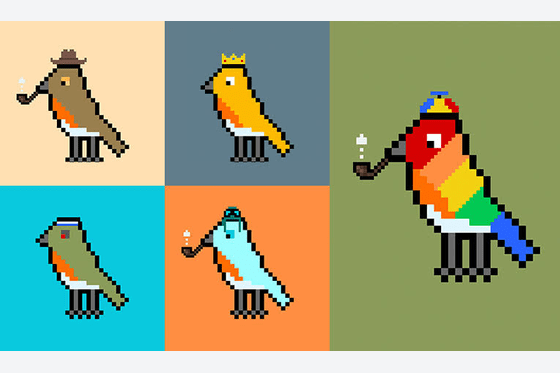

Stackspunks:

StacksPunks have generated nearly $2.9 million worth of trading volume to date from people who want to snag a rainbow-draped copycat for a fraction of the price of the real deal. A CryptoPunk starts at 115 ETH, or $415,000. A StacksPunk starts at 60 STX, or $82

Boomboxes:

Another project called Boomboxes treats NFTs like staking rewards in a DeFi yield farming effort: users who stake their STX, or lock it up within the network, receive NFTs in return. That project already has more than $1 million worth of assets locked up.

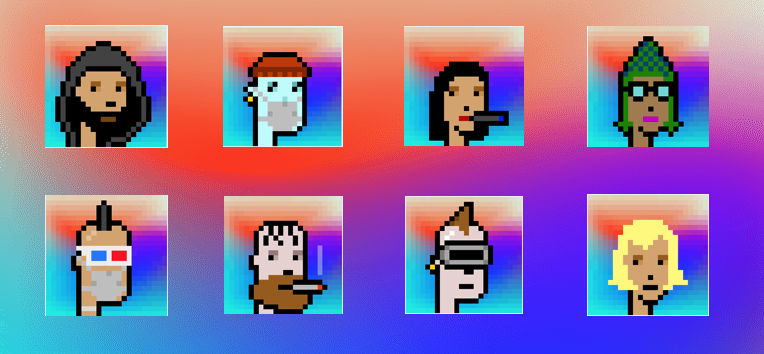

Blocks:

Blocks embeds binary messages in unique colorful grids. Each NFT consists of a completely different set of squares with individual messages further defining rarity. Each grid, color and pattern are random. The floor price at the time of writing is 85 STX.

Byte Fighters:

ByteFighters are 1,000 unique fighters defending the Stacks blockchain. A wide variety of attributes ensures your fighter will stand out from the rest; no two are the same.

Phases of Satoshi:

No one knows what Satoshi Nakamoto actually looked like. The possibilities of his appearance are reflected in these NFTs secured by the blockchain he created. Unique age, race body type, and gender variations may create the real Satoshi Nakamoto. The floor price at the time of writing is 3000 STX.

Conclusion:

Many hodlers of NFTs would obviously prefer to store their NFTs on Bitcoin rather than Ethereum. Since the Bitcoin community is very true to Bitcoin, they tend to have reservations about using ETH to purchase NFTs. To build a network to compete with Ethereum on top of Bitcoin and you logically think through all the steps, the network, functionality, incentives, ecosystem, talent, capital, scale, etc. etc. The answer is simple: Stacks. NFTs on Bitcoin will win for sure. Grab your NFTs secured by Bitcoin before it is too late.